DOE Financial Disclosure Statement free printable template

Show details

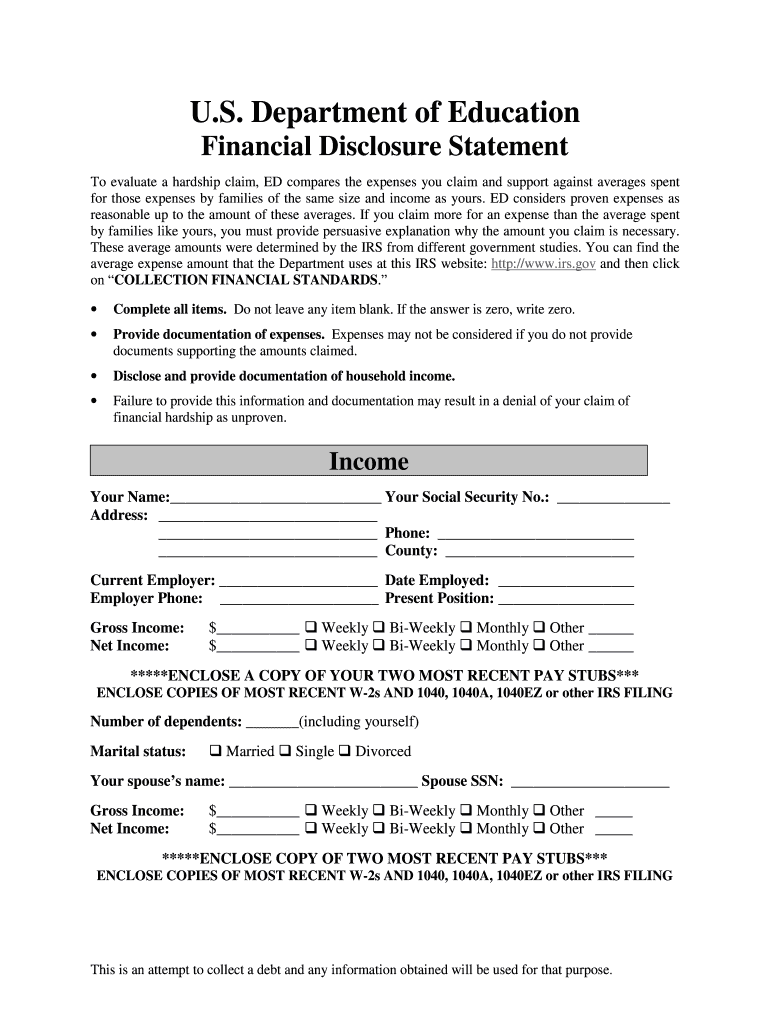

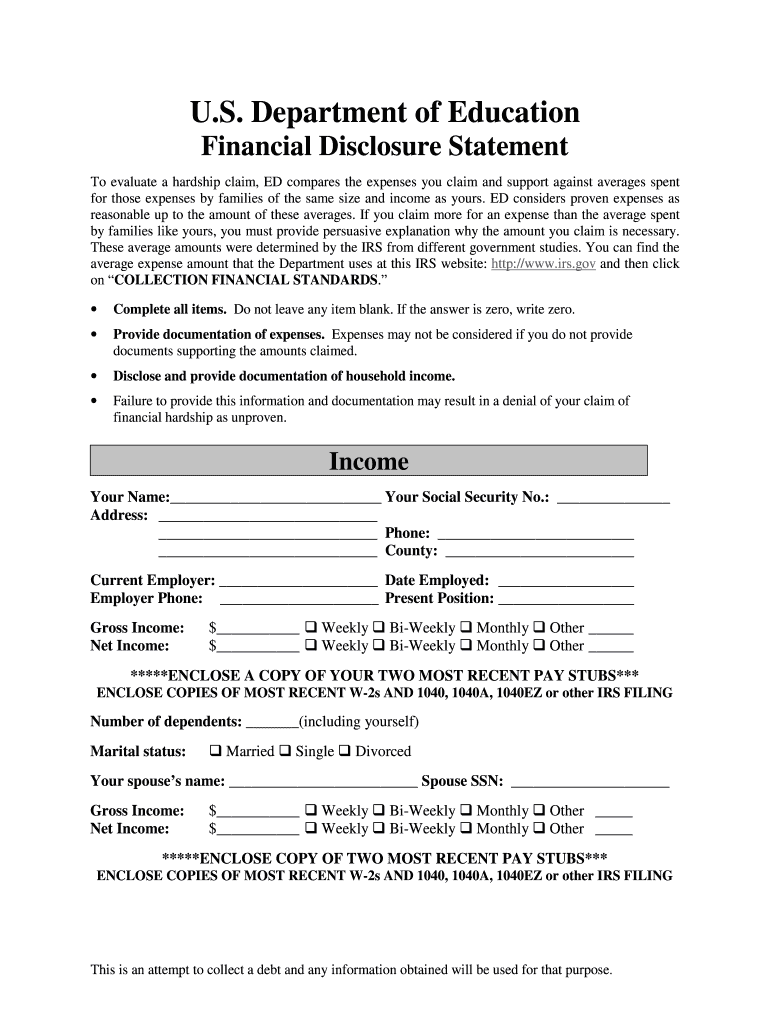

U.S. Department of Education Financial Disclosure Statement To evaluate a hardship claim ED compares the expenses you claim and support against averages spent for those expenses by families of the same size and income as yours. ED considers proven expenses as reasonable up to the amount of these averages. If you claim more for an expense than the average spent by families like yours you must provide persuasive explanation why the amount you claim is necessary. These average amounts were...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign education financial disclosure statement form

Edit your irs offices internal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your doe financial disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing education financial statement online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit doe financial statement printable form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs filing identification form

How to fill out DOE Financial Disclosure Statement

01

Obtain the DOE Financial Disclosure Statement form from the appropriate official source.

02

Read the instructions provided with the form thoroughly to understand the requirements.

03

Fill in your personal information, including name, position, and contact details at the top of the form.

04

Provide details regarding your financial interests, including stocks, bonds, real estate, and other assets.

05

Disclose any sources of income outside of your government employment, such as freelance work or consulting.

06

Report any potential conflicts of interest that may arise from your financial interests.

07

Review the completed form for accuracy and ensure all required sections are filled out.

08

Sign and date the form to certify that the information provided is true and accurate.

09

Submit the form to the designated ethics office or authority as instructed.

Who needs DOE Financial Disclosure Statement?

01

Federal employees and officials who are required to disclose their financial interests to avoid conflicts of interest.

02

Individuals in positions that may influence government contracts or decisions that could impact their financial interests.

03

Employees of the Department of Energy or related agencies as part of compliance with federal ethics regulations.

Fill

ez taxpayer

: Try Risk Free

People Also Ask about irs taxpayer offices

How do I get a taxpayer ID number?

You can use the IRS's Interactive Tax Assistant tool to help determine if you should file an application to receive an Individual Taxpayer Identification Number (ITIN). To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number.

What form do I need to request a tax ID number?

Use Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN, or Form SS-4, Application for Employer Identification Number, to apply for an EIN.

What is a taxpayer ID form?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid. Acquisition or abandonment of secured property.

Is TIN the same as SSN?

A tax identification number (TIN) is used for filing tax returns and exists in different forms. A Social Security number (SSN) is a type of tax ID number just like an Employer Identification Number (EIN) is, the difference being the former is for individuals and the latter for businesses.

Can I use my SSN as my TIN?

As the withholding agent, you must generally request that the payee provide you with its U.S. taxpayer identification number (TIN). You must include the payee's TIN on forms, statements, and other tax documents. The payee's TIN may be any of the following. An individual may have a Social Security number (SSN).

Are TIN and SSN the same number?

A tax identification number (TIN) is used for filing tax returns and exists in different forms. A Social Security number (SSN) is a type of tax ID number just like an Employer Identification Number (EIN) is, the difference being the former is for individuals and the latter for businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send doe financial disclosure printable to be eSigned by others?

Once your identification schedule code is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit employer tin identification online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your financial disclosure form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit taxpayer offices tin on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as financial disclosure form template. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is DOE Financial Disclosure Statement?

The DOE Financial Disclosure Statement is a document that requires certain individuals to disclose their financial interests and relationships to prevent conflicts of interest in Department of Energy activities.

Who is required to file DOE Financial Disclosure Statement?

Individuals who are designated as 'confidential filers' within the Department of Energy, including employees and certain contractors, are required to file the DOE Financial Disclosure Statement.

How to fill out DOE Financial Disclosure Statement?

To fill out the DOE Financial Disclosure Statement, individuals must provide details about their financial interests, including income sources, stocks, real estate, and other financial holdings, in accordance with the instructions provided by the Department.

What is the purpose of DOE Financial Disclosure Statement?

The purpose of the DOE Financial Disclosure Statement is to identify and manage potential conflicts of interest by ensuring transparency about the financial interests of individuals involved with the Department of Energy.

What information must be reported on DOE Financial Disclosure Statement?

The information required on the DOE Financial Disclosure Statement includes details about compensation from employment, business investments, ownership of real estate, gifts, and other financial interests that could potentially influence decision-making.

Fill out your DOE Financial Disclosure Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Disclosure Statement is not the form you're looking for?Search for another form here.

Keywords relevant to financial disclosure forms

Related to social security tax forms 2025

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.