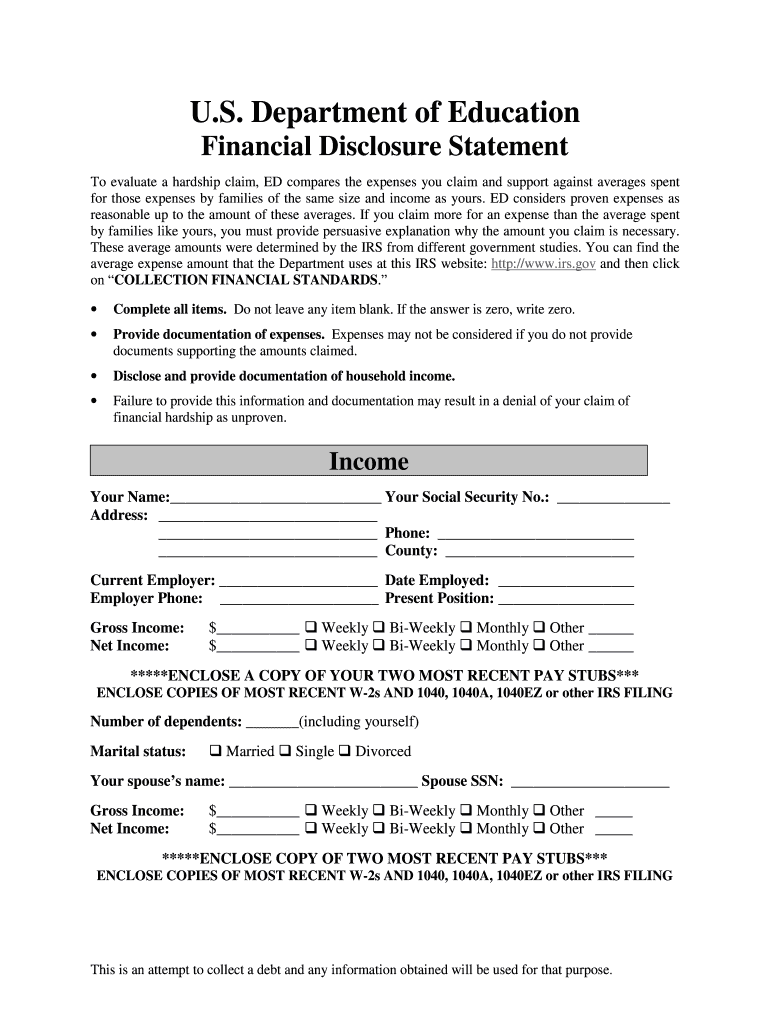

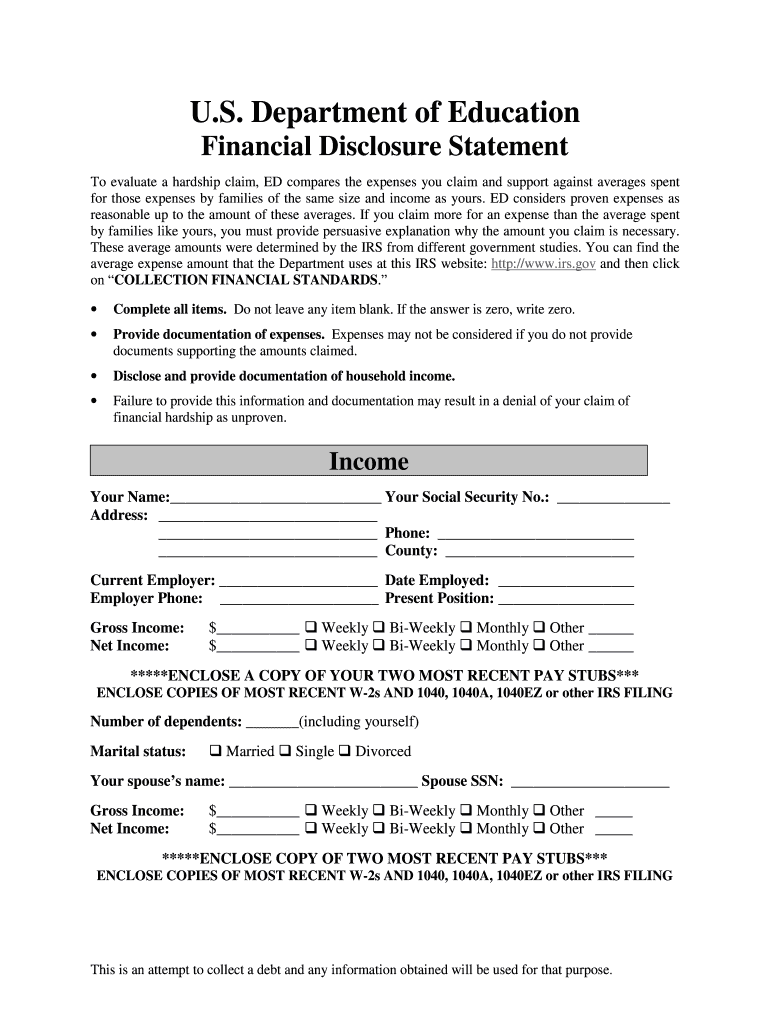

Get the free taxpayer identification code form

Get, Create, Make and Sign

Editing taxpayer identification code online

How to fill out taxpayer identification code form

How to fill out taxpayer identification code:

Who needs taxpayer identification code:

Video instructions and help with filling out and completing taxpayer identification code

Instructions and Help about code revenue form

Good day subscribers thank you so much for joining me today I am Jeremy this is the financial education Channel, and today we're talking about income statement what is it any kind of statement on your screen today I'm going to put up an income statement, and I'm going to go through the line with you guys on what each category means in the income statement and put it in the easiest way possible, so you can remember when you look at an income statement in the future exactly what that line category means I'm also going to share with you guys what's the most important things on the income statement, and you know before I get into the video I just want to share with you guys income statement is vital because every single person whoever is thinking about investing a stock you need to know what an income statement is every person who's ever thinking about starting a business you need to know what an income statement is you need to know what each category on an income statement is it is extremely, extremely vital there's no way around it, you have to know, so I just want to share that with you guys and let's go ahead and get into this so on your screen now I should be showing you an income statement for Apple Corporation apples an awesome company to do this on because everybody knows Apple you know if you don't own a product of it you probably know somebody that owns an Apple product so the first few things you're going to recognize here to see up there at the top it says income statement you're going to notice that there are three years here there's 2013 there's 2014 there's 2015, so there's all three years on most income statements you look at they're going to show the last three years if not the last five years just to give you some reference to look at and say okay you know revenues going up or profits going up or this or that, so you generally are going to show three years so the first thing we're going to look at we're going to look at you see the part that says annual data quarterly data we're looking at the annual data, so that's the amount that happened over the entire year so revenue over the entire year cost of revenue you know gross profit all those things over the entire year we're looking at you'll one so the first category you're going to see there is total revenue it's right under period editing total revenue you're going to see in 2013 if you go all the way to the far right they did 170 now that looks like it says 170 million in total revenue but all the numbers are in thousands they're all in thousands meaning they actually did one hundred and seventy billion dollars in revenue 170 billion dollars in revenue in 2013 if you go one year over there under total revenue in 2014 September 27, 2014, they did 182 billion in revenue in this past year September 26, 2015, that year ending they did 233 billion dollars in total revenue is exactly what it is it's the total revenue it's a total amount of money coming into the company it's not...

Fill identification code : Try Risk Free

People Also Ask about taxpayer identification code

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your taxpayer identification code form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.